California offers various tax benefits and exemptions for seniors, though it is generally considered a higher-tax state. Here’s a detailed breakdown of the tax treatment for seniors in California, including property taxes, Social Security, pensions, investment income, and retirement accounts like 401(k), IRA, Roth IRA, 457, and 403(b):

1. Property Tax Benefits for Seniors

- Proposition 19: Seniors aged 55+ can transfer their primary residence’s property tax basis to a new home of equal or lesser value up to three times, anywhere in the state. This helps prevent higher taxes when downsizing or relocating.

- Homeowners’ Exemption: Seniors qualify for the basic homeowner’s exemption of $7,000 off the home’s assessed value.

- Property Tax Postponement Program: Homeowners aged 62+ with a household income below $45,000 can defer their property taxes until the sale or transfer of the home.

2. Social Security Tax in California

- Exempt from State Tax: Social Security benefits are not taxed by the state of California, regardless of income level.

- Federal Tax on Social Security: Up to 85% of Social Security benefits may be taxed at the federal level, depending on your income.

3. Tax on Pensions and Retirement Income

- California Taxes Most Pensions: California taxes public and private pensions as ordinary income, meaning the income is subject to the state’s graduated income tax rate (1% to 13.3%).

- Out-of-state Pensions: These are also subject to California income tax if you reside in the state.

- Federal and Military Pensions: No special exemption for these pensions—they are fully taxable by California.

4. Investment Income Tax (Including 401(k), IRA, Roth IRA, 457, and 403(b))

- Traditional 401(k) and IRA Withdrawals: Distributions are taxed as ordinary income at the state level (1% to 13.3% based on income).

- Roth IRA: Qualified withdrawals (after age 59½ and after holding the account for five years) are tax-free at both the state and federal levels.

- 403(b) and 457 Plans: Withdrawals from these plans are treated the same as 401(k) plans and taxed as ordinary income.

- Required Minimum Distributions (RMDs): California taxes RMDs as part of your taxable income.

- Capital Gains and Investment Income: California does not differentiate between short-term and long-term capital gains—both are taxed as ordinary income. There is no special capital gains tax rate in California.

5. Income Tax Breaks for Seniors

- Standard Deduction: Seniors (65+) can take an additional $1,750 if filing singly or $1,400 per spouse if married filing jointly.

- Medical Expenses Deduction: Unreimbursed medical expenses exceeding 7.5% of adjusted gross income (AGI) are deductible at both state and federal levels.

- Tax Credit for Seniors or Disabled Individuals: California offers a small non-refundable tax credit for seniors aged 65+ with low to moderate income.

6. Tax on Dividends and Interest Income for Seniors

- Dividends and interest from investments (e.g., stocks, bonds, savings accounts) are taxed at the ordinary state income tax rates (up to 13.3%).

- Municipal Bond Interest: Interest from California municipal bonds is tax-exempt at the state level.

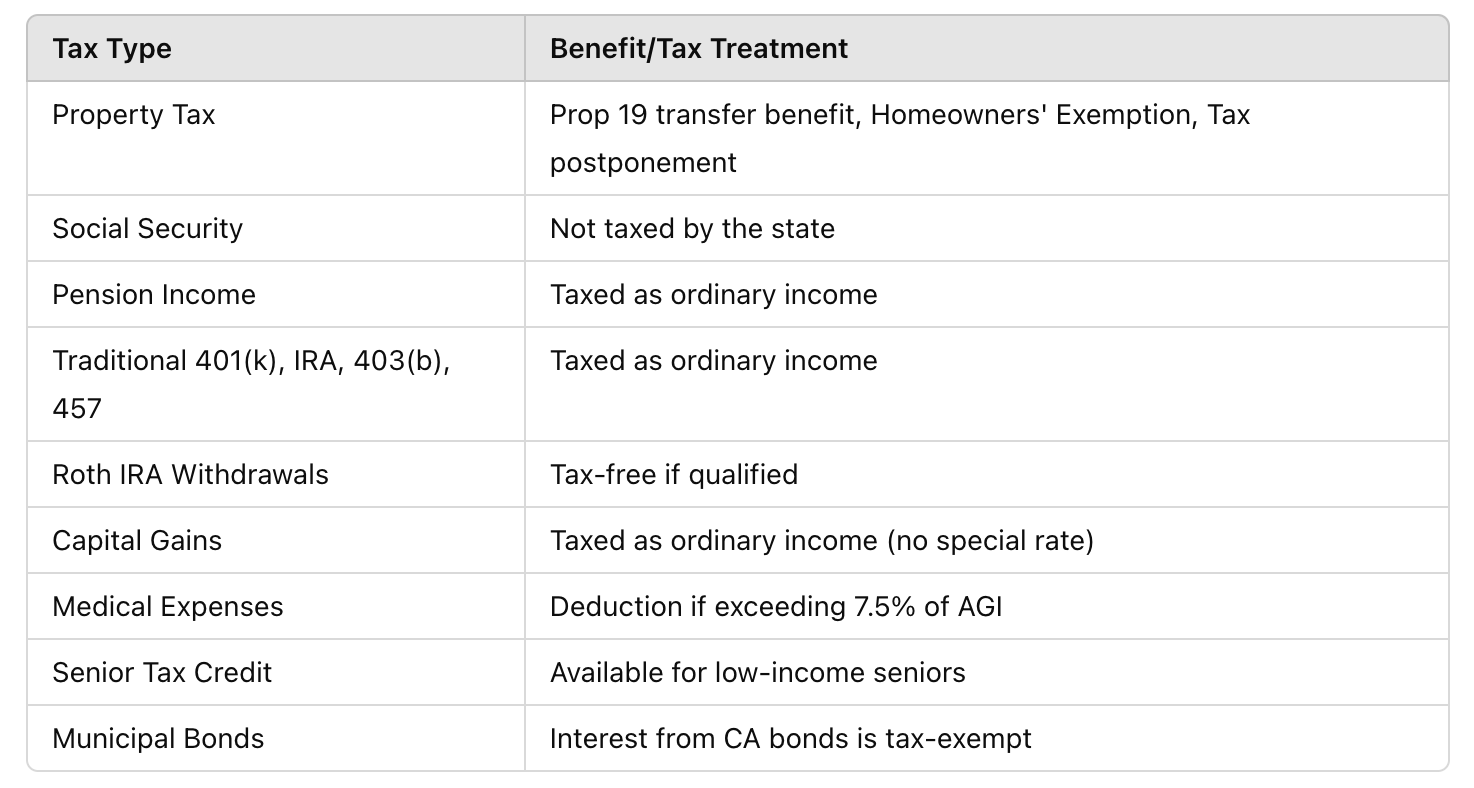

Summary Table: Senior Tax Benefits and Breaks in California

Key Considerations for Retirees in California

- No State Inheritance or Estate Tax: California does not impose estate or inheritance taxes, which is a benefit compared to some other states.

- High Income Tax Rates: California’s tax on pensions and retirement distributions can add up for seniors with significant retirement income.

- Medical Deduction: Managing out-of-pocket medical costs can lead to valuable deductions, especially in later years.

- Plan Withdrawals: Roth IRA withdrawals are favorable since they are not taxed, which could help seniors minimize taxable income in retirement.

California offers helpful exemptions on property taxes and Social Security benefits but has high income tax rates on most other retirement income. Careful planning can help retirees leverage Roth IRAs, municipal bonds, and tax deductions for medical expenses to manage their overall tax burden effectively.

-Lê Nguyễn Thanh Phương-

Here are some reliable sources for further reading and research on tax benefits for seniors in California:

- California Franchise Tax Board (FTB) – Senior Tax Information

Provides detailed information about income taxes, tax credits, and exemptions for seniors in California.

Visit the California FTB website - Social Security Administration (SSA) – Taxation of Benefits

Explains how Social Security benefits are taxed at the federal level and provides guidelines for seniors on filing requirements.

Visit the SSA website - Internal Revenue Service (IRS) – Tax Guide for Seniors

The IRS publication that offers information on tax benefits for seniors, including tax credits, deductions, and how to file returns with retirement income.

Visit IRS Tax Guide for Seniors - California State Controller – Property Tax Postponement Program

This resource provides details on how seniors can defer their property taxes in California.

Visit the State Controller’s Office website

These sources offer comprehensive insights and updates on tax-related matters for seniors in California, helping retirees make informed decisions.