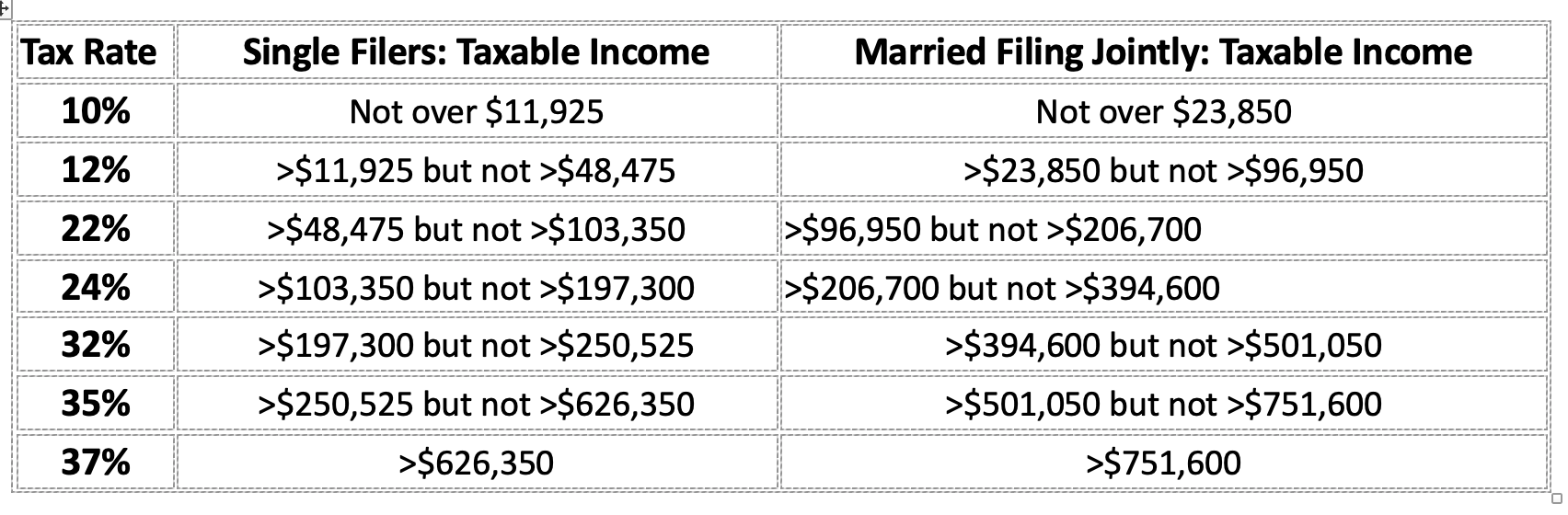

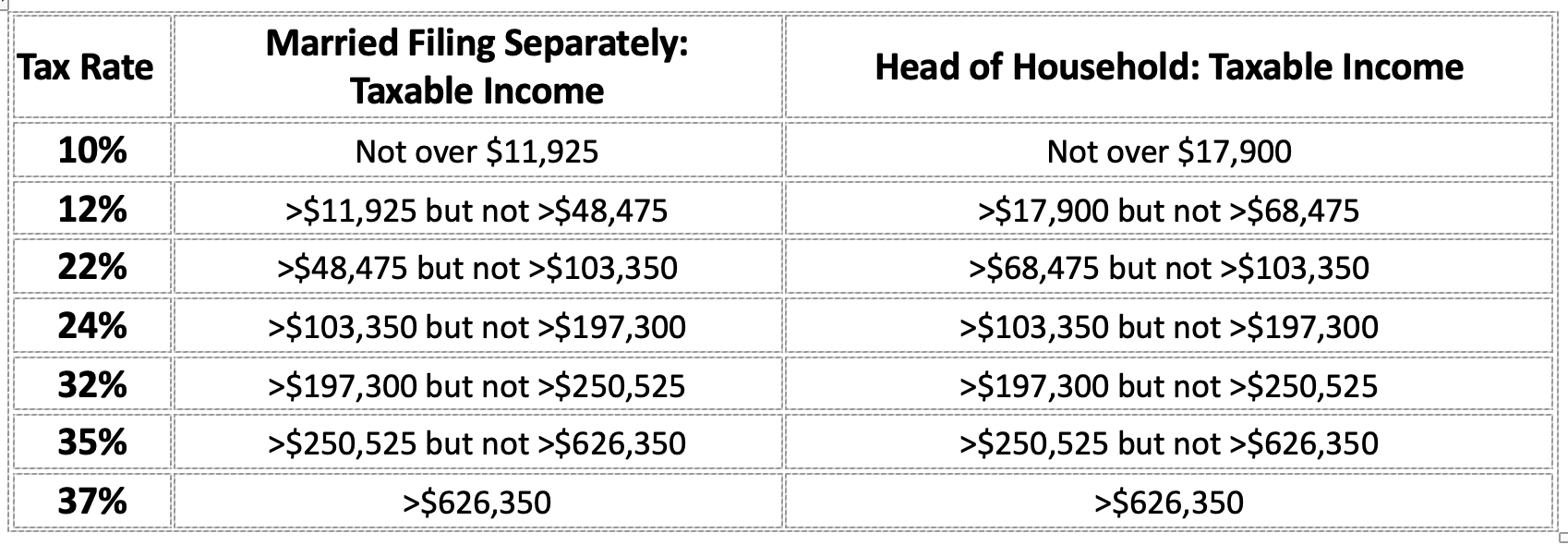

For the 2025 tax year, the IRS has adjusted income tax brackets and standard deductions to account for inflation. Below are the updated tax brackets for different filing statuses:

2025 Federal Income Tax Brackets

Single Filers vs. Married Couples Filing Jointly:

Married Couples Filing Separately vs. Head of Household Filers:

Married Couples Filing Separately vs. Head of Household Filers:

These brackets are progressive, meaning income is taxed at different rates as it moves through each bracket. For example, a married couple filing jointly with a taxable income of $120,000 would have their income taxed as follows:

- First $23,850 at 10%: $2,385

- Next $73,100 ($96,950 – $23,850) at 12%: $8,772

- Remaining $23,050 ($120,000 – $96,950) at 22%: $5,071

Total Tax: $2,385 + $8,772 + $5,071 = $16,228

This progressive taxation applies to all filing statuses, including single filers.

2025 Standard Deductions:

- Single Filers: $15,000 (an increase of $400 from 2024)

- Married Filing Jointly: $30,000 (an increase of $800 from 2024)

- Head of Household: $22,500 (an increase of $600 from 2024)

These adjustments are designed to account for inflation and may change annually. irs.gov

For more detailed information, you can refer to the IRS’s official announcement on tax inflation adjustments for tax year 2025. irs.gov

-Lê Nguyên Vũ-