The Social Security Cost of Living Adjustment (COLA) is an annual increase in Social Security benefits to help recipients maintain purchasing power in response to inflation. It ensures that Social Security and Supplemental Security Income (SSI) benefits keep pace with rising prices. The Social Security Administration (SSA) calculates COLA based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

How is COLA Calculated?

COLA is determined by the percentage increase in the CPI-W from the third quarter of one year to the third quarter of the next year. If there is no increase in the CPI-W, there is no COLA. The calculation follows this formula:

- Average CPI-W for the third quarter of the current year minus the average CPI-W for the third quarter of the previous year.

- If the result is positive, the increase percentage becomes the COLA for the following year.

Outlook for 2025

While the exact COLA for 2025 won’t be determined until October 2024, the forecast depends on inflation trends. If inflation persists or accelerates, a higher COLA may be expected, but if inflation moderates, the increase could be smaller. Based on recent trends, the 2025 COLA is projected to increase by approximately 3.2% to 3.5%.

COLA vs. Inflation

While COLA is designed to help beneficiaries keep up with inflation, it may not always fully reflect the actual inflationary impact that seniors face, particularly since healthcare and housing costs can rise faster than the CPI-W index, which focuses more on general goods consumed by urban wage earners.

Does Medicare Affect COLA?

Yes, Medicare costs can reduce the effective COLA. For example, if Medicare Part B premiums rise faster than the COLA increase, the net Social Security benefit after deducting the Medicare premium could result in little to no gain for beneficiaries.

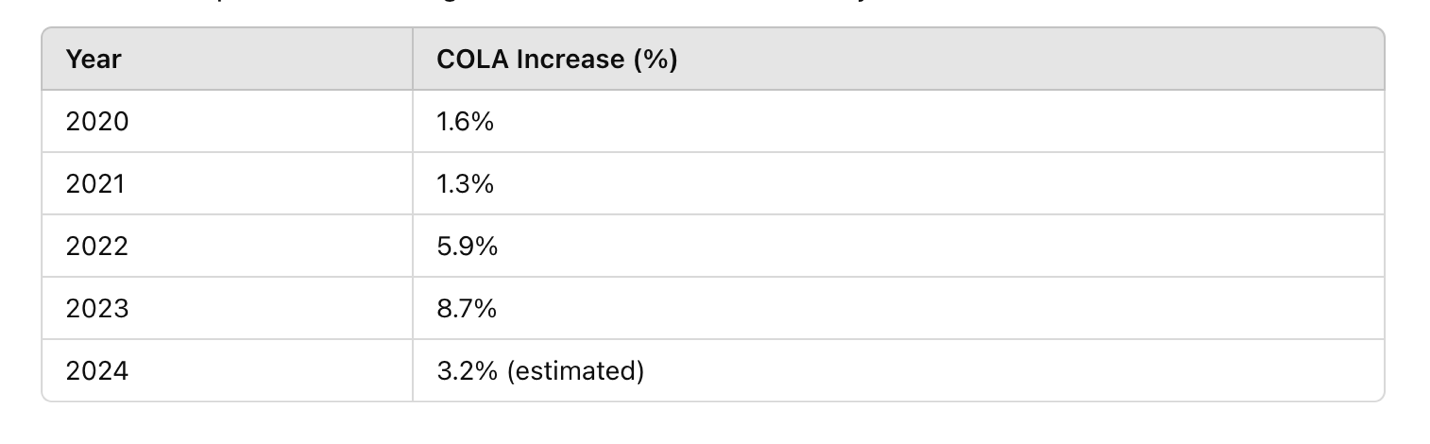

COLA Increases from 2020 to 2024

Here is a simple chart showing COLA increases over recent years:

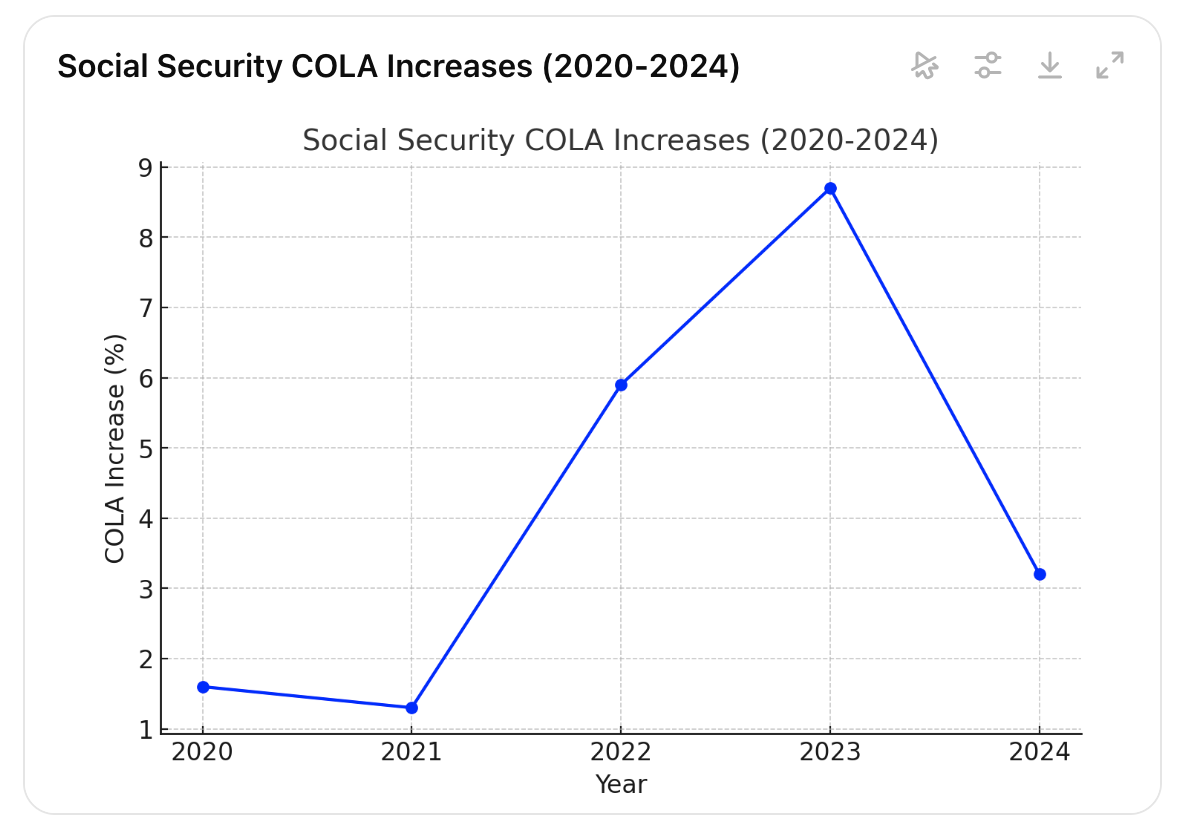

Here is a visual representation of the Social Security COLA increases from 2020 to 2024, showing fluctuations in adjustments made based on inflation over the years.

– Lê Nguyên Vũ –

Further Reading and References:

- Social Security Administration – Understanding COLA

- AARP – COLA History and Impact

- U.S. Bureau of Labor Statistics – Consumer Price Index

These sources provide more in-depth details on how COLA works and how it might change in the future.