In Georgia, seniors enjoy several tax benefits and breaks that make the state attractive for retirees. Here’s a detailed overview of these benefits across different tax categories:

1. Property Taxes

- Homestead Exemptions:

Georgia offers several homestead exemptions for seniors, which reduce the taxable value of their home:- Senior School Tax Exemption: Homeowners aged 62 or older may qualify to exempt some or all of their property’s assessed value from school taxes, the largest portion of property taxes.

- Statewide Homestead Exemption: Homeowners 65 or older receive an additional $4,000 exemption for county, municipal, and school taxes.

- Some counties offer local tax exemptions specifically for seniors, which can be more generous than the statewide exemptions.

- Assessment Freezes:

Some counties allow property value assessment freezes once the homeowner turns 65, preventing property taxes from increasing even if the home’s market value rises.

2. Income Taxes on Social Security Benefits

- Full Exemption:

Georgia does not tax Social Security benefits. All payments received from Social Security are fully excluded from state income tax.

3. Pension and Retirement Income Tax Breaks

- Retirement Income Exclusion:

Seniors aged 62 to 64 can exclude up to $35,000 of retirement income annually from state taxes.- Once they reach 65, the exclusion rises to $65,000 per person ($130,000 for couples filing jointly).

- This exclusion covers:

- Pensions (public or private)

- 401(k) withdrawals

- IRA distributions

- Annuities

Note: Any income above the exclusion amount is taxed at Georgia’s state income tax rate, which ranges from 1% to 5.75%.

4. 401(k), IRA, Roth IRA, and 457/403(b) Plans

- 401(k) and IRA Withdrawals:

Withdrawals from 401(k), Traditional IRAs, and other pre-tax retirement accounts are eligible for the retirement income exclusion mentioned above.- If the total withdrawal exceeds the exclusion limit, the excess amount is taxed at the state’s income tax rate (1%-5.75%).

- Roth IRA Distributions:

Qualified withdrawals from a Roth IRA are tax-free at both the federal and state levels. - 457 and 403(b) Plans:

Withdrawals from these employer-sponsored retirement plans also qualify for the retirement income exclusion, following the same rules as for 401(k) and IRA withdrawals.

5. Investment Income Taxes

- Interest and Dividends:

Investment income, such as interest from savings accounts or dividends, is taxable. However, it is eligible for the retirement income exclusion once seniors turn 62. - Capital Gains:

Capital gains are treated as regular income for tax purposes in Georgia. Seniors can use the retirement income exclusion to offset any gains realized from the sale of investments.

6. Additional Benefits for Seniors

- Medical Expense Deductions:

Georgia allows a deduction for unreimbursed medical expenses exceeding 7.5% of adjusted gross income (AGI) if itemizing deductions. This can benefit seniors with high healthcare costs. - No Estate or Inheritance Taxes:

Georgia does not impose estate taxes or inheritance taxes, providing relief for retirees planning wealth transfers to heirs.

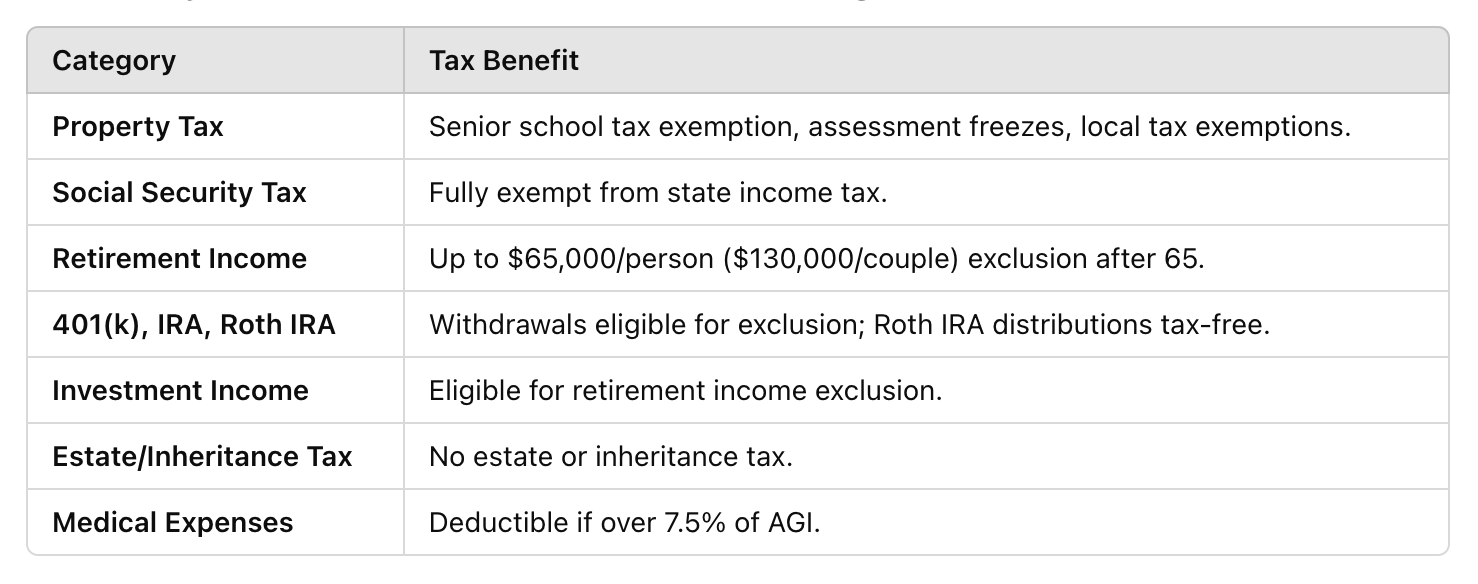

Summary of Tax Benefits for Seniors in Georgia

Georgia offers a retiree-friendly tax environment, with substantial exclusions on retirement income, full Social Security tax exemption, and no estate or inheritance taxes. Seniors can also benefit from property tax relief through homestead exemptions and local assessment freezes, ensuring a more affordable cost of living throughout retirement.

-Nguyễn Bách Khoa-

Below are some additional reading materials and resources for further research on tax benefits and retirement planning for seniors in Georgia:

- Georgia Department of Revenue

- Provides official information on various tax benefits, including property tax exemptions, retirement income exclusions, and tax filing rules.

- Website: Georgia Department of Revenue – Taxpayer Services

- Georgia Property Tax Exemptions for Seniors

- Offers detailed information about property tax exemptions available to seniors, including local programs in different counties.

- Resource: Georgia Tax Center Property Tax Exemptions

- IRS – Retirement Topics

- Federal tax resources explaining the taxation of retirement accounts, Social Security benefits, Roth IRAs, and more.

- Website: IRS – Retirement Plans and Benefits

- 4. Retirement Income Taxation by State

- A comprehensive overview of how each U.S. state, including Georgia, taxes retirement income like Social Security, pensions, 401(k), and IRAs.

- Resource: Kiplinger – State-by-State Guide to Taxes on Retirees

- 5. Georgia Council on Aging – Senior Tax Assistance

- Provides resources and guidance for seniors seeking financial assistance, tax relief, and local support programs in Georgia.

- Website: Georgia Council on Aging

- 6. Social Security Administration – Benefits for Seniors

- Official government information on how Social Security benefits are calculated and taxed, along with Medicare resources and income limits.

- Website: Social Security Administration

- 7. Financial Planning Association (FPA) – Retirement Planning Resources

- Offers guidance and articles on retirement planning, including tax-efficient strategies for using 401(k)s, IRAs, Roth IRAs, and pensions.

- Website: Financial Planning Association – Retirement Resources

- 8. Investopedia – Guide to Retirement Taxes

- In-depth articles explaining different types of taxes retirees face, including capital gains, dividend taxes, and investment income taxation.

- Website: Investopedia – Taxes in Retirement

These resources can help you explore tax-related information specific to Georgia and general retirement planning strategies.