The IRS has recently announced updates to contribution limits for Individual Retirement Accounts (IRAs) and employer-sponsored retirement plans, effective for the 2024 and 2025 tax years. Here’s a comprehensive overview:

IRA Contribution Limits:

- 2024:

- Individuals under 50 can contribute up to $7,000.

- Individuals 50 and older can contribute up to $8,000, which includes a $1,000 catch-up contribution.

- 2025:

- The contribution limits remain the same as in 2024: $7,000 for those under 50 and $8,000 for those 50 and older.

401(k) and Similar Employer-Sponsored Plans:

- 2024:

- The contribution limit is $23,000.

- Individuals 50 and older can make an additional catch-up contribution of $7,500, bringing the total to $30,500.

- 2025:

- The contribution limit increases to $23,500.

- The catch-up contribution for those 50 and older remains $7,500, totaling $31,000.

- For individuals aged 60 to 63, a higher catch-up contribution limit of $11,250 applies, making their total contribution limit $34,750.

SECURE 2.0 Act Provisions:

- Catch-Up Contributions:

- Starting in 2025, individuals aged 60 to 63 can make catch-up contributions of up to $11,250 to 401(k), 403(b), and governmental 457 plans.

- Roth Catch-Up Contributions:

- Initially, the SECURE 2.0 Act required that, beginning in 2024, catch-up contributions for individuals earning over $145,000 be made as Roth (after-tax) contributions. However, the IRS has provided a two-year administrative transition period, delaying this requirement until 2026.

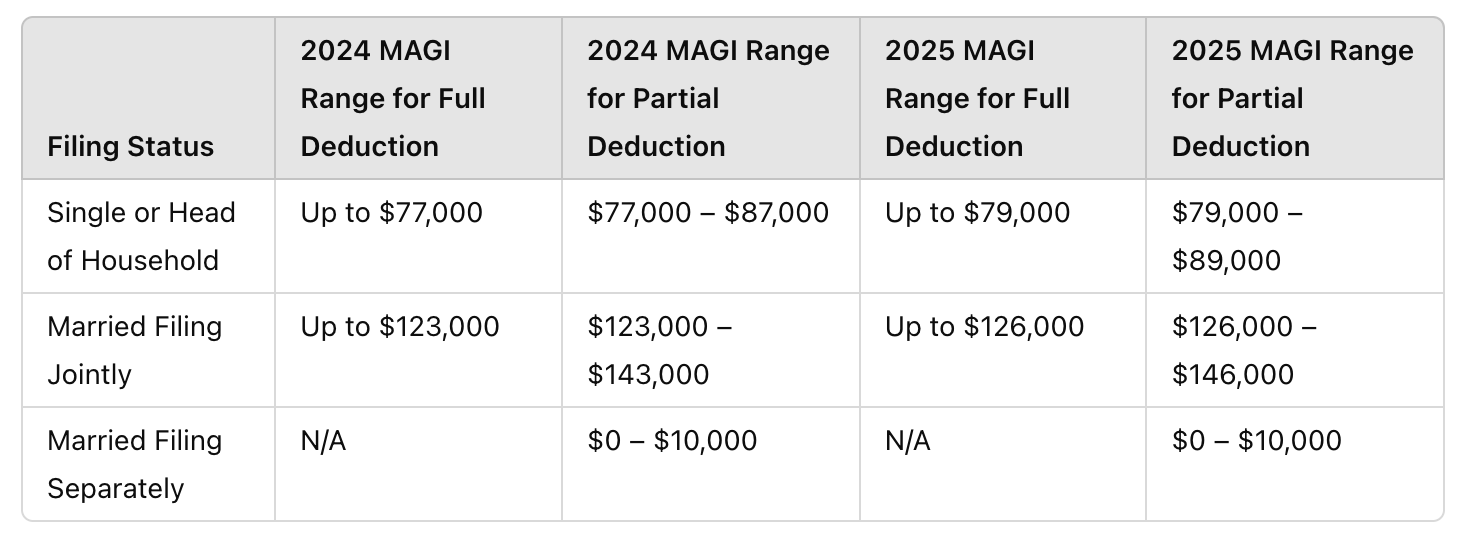

Income Limits for IRA Contributions:

- Traditional IRA Deductibility:

- For single filers covered by a workplace retirement plan, the deduction phases out between $77,000 and $87,000 of modified adjusted gross income (MAGI) in 2024.

- For married couples filing jointly, where the spouse making the IRA contribution is covered by a workplace plan, the phase-out range is $123,000 to $143,000 of MAGI in 2024.

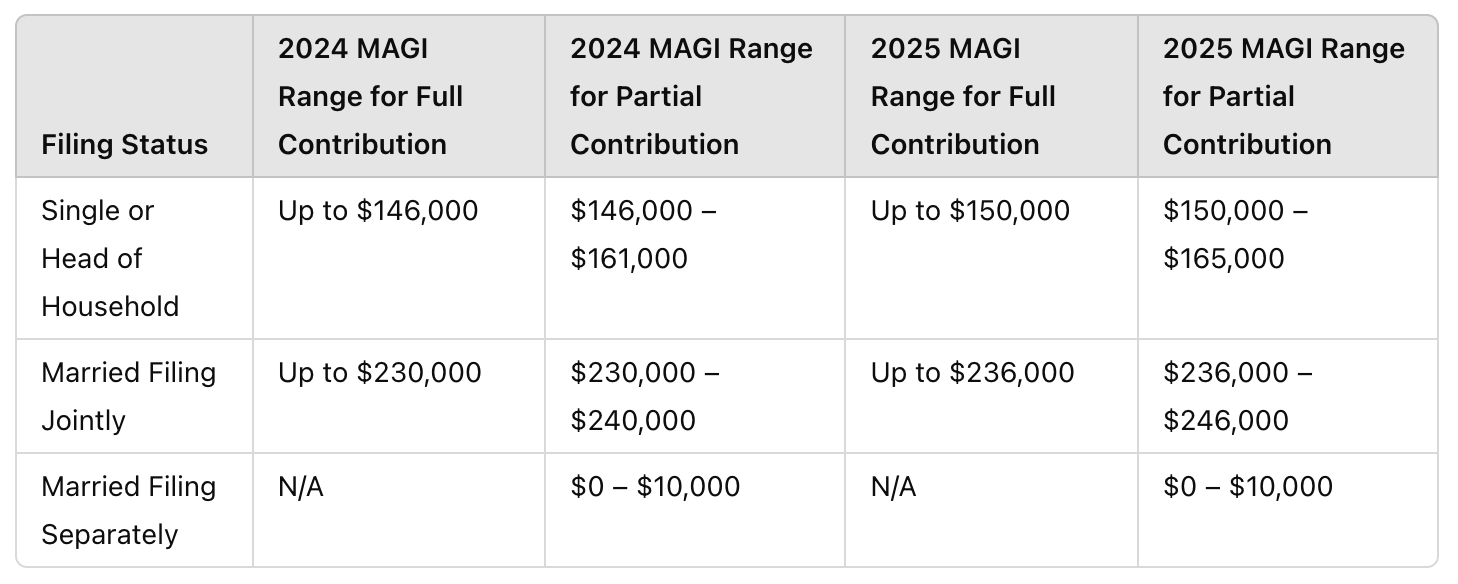

- Roth IRA Contributions:

- For single filers, the ability to contribute phases out between $146,000 and $161,000 of MAGI in 2024.

- For married couples filing jointly, the phase-out range is $230,000 to $240,000 of MAGI in 2024.

These adjustments aim to help more Americans save for retirement by increasing contribution limits and adjusting income thresholds. It’s advisable to consult with a financial advisor to understand how these changes impact your individual retirement planning.

Key Points:

- Traditional IRA Deduction: The ability to deduct contributions depends on your income, filing status, and whether you’re covered by a workplace retirement plan. If neither you nor your spouse is covered by such a plan, you can deduct the full contribution regardless of income.

- Roth IRA Contributions: Eligibility to contribute is based on income levels. If your MAGI exceeds the phase-out range, you cannot contribute directly to a Roth IRA.

- Catch-Up Contributions: Individuals aged 50 and older can make additional contributions to IRAs and employer-sponsored plans. Starting in 2025, those aged 60 to 63 have higher catch-up limits for certain plans.

-Nguyễn Bách Khoa-

For more detailed information, refer to the IRS announcements and financial institution guidelines:

- IRS Newsroom: 401(k) Limit Increases to $23,000 for 2024; IRA Limit Rises to $7,000

- Fidelity: IRA Contribution Limits for 2024 and 2025

- NerdWallet: Roth IRA Income and Contribution Limits 2024-2025

- Barron’s: Here Are the IRA and 401(k) Contribution Limits for 2025

Consult with a financial advisor to understand how these changes impact your individual retirement planning.