Here is a detailed overview of California’s tax information for 2024, including income tax brackets, property tax, sales tax, and other specific taxes relevant to residents, with a focus on how pensions, retirement income, and investment income are taxed, as well as potential tax breaks for residents aged 65 or older.

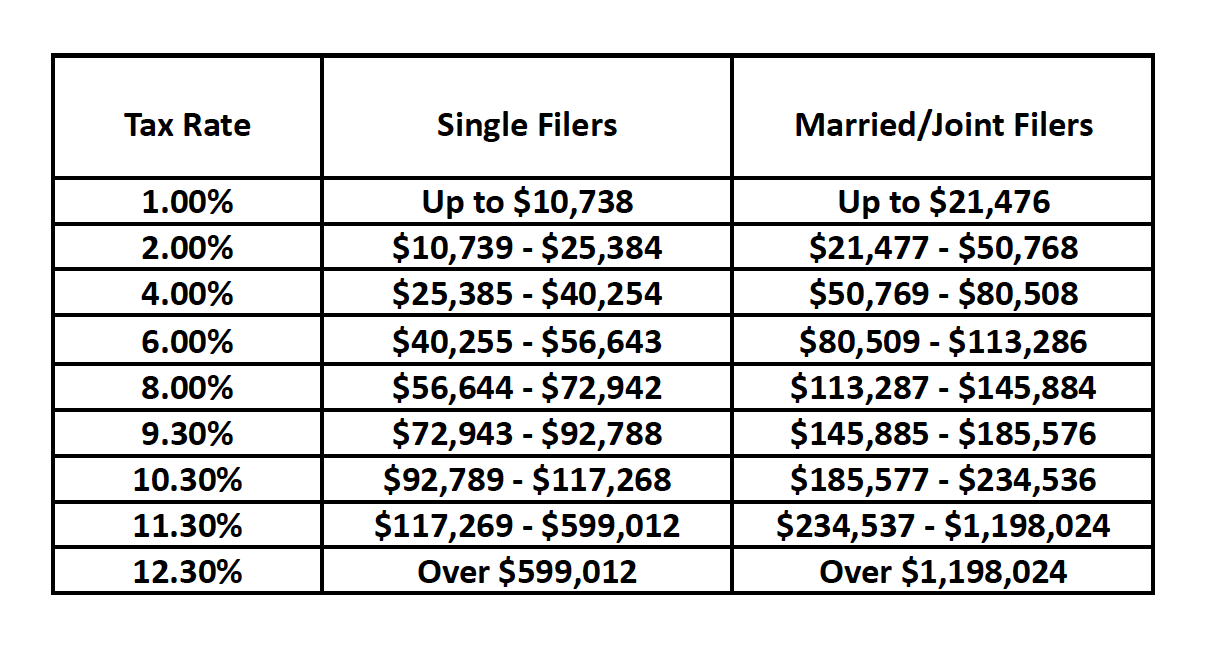

California Income Tax Brackets for 2024

Property Tax

- Base Rate: The average effective property tax rate in California is 0.73% of assessed value.

- Proposition 13: Limits the maximum amount of property tax to 1% of the assessed value, with annual increases capped at 2% for properties that are not sold or newly constructed.

Sales Tax

- Base Sales Tax Rate: 7.25%

- Additional Local Taxes: Can increase the total sales tax to up to 10.75% in certain areas.

Taxes on Specific Items

- Groceries: Essential groceries are exempt from sales tax.

- Gasoline: 59.4 cents per gallon (as of 2024).

- Diesel: 48.8 cents per gallon (as of 2024).

- Alcohol: Varies by type; e.g., 20 cents per gallon of beer, 30 cents per gallon of wine, $3.30 per gallon of spirits over 100 proof.

- Lottery Winnings: California does not tax lottery winnings.

- Cigarettes: $2.87 per pack of 20 cigarettes.

Taxation of Retirement Income

- Social Security Benefits: Not taxed by the state.

- Pensions: Fully taxed as regular income.

- 401(k) and IRA Withdrawals: Taxed as regular income.

- Investment Income: Dividends and capital gains are taxed as regular income, but capital gains are taxed at the income tax rate applicable to the taxpayer.

Tax Breaks for Residents Aged 65 or Older

- Property Tax Postponement Program: Allows homeowners aged 62 or older to defer property taxes on their primary residence.

- Senior Exemption: Low-income seniors (65+) may qualify for property tax exemptions under local ordinances.

- Medical Deduction: Unreimbursed medical and dental expenses exceeding 7.5% of adjusted gross income (AGI) can be deducted.

- Retirement Savings Credit: Individuals aged 65 or older with low to moderate income may qualify for a nonrefundable credit on federal tax returns, which could reduce state tax liability.

This overview should help you navigate the tax landscape in California, especially as it pertains to retirement and investment income. If you need more detailed information, please check out the informartion below.

-Nguyễn Bách Khoa-

- California Franchise Tax Board

- California Department of Tax and Free Administration

- IRS.gov

- California State Board of Equalization

- Tax Foundation