For adults 50+, there are several tax breaks in 2025 that can help reduce taxable income and boost retirement savings. Below are key opportunities, including calculations for someone earning $80,000 per year and strategies for those aged 60-63 to take advantage of the catch-up contributions.

1. Traditional 401(k) Contributions (Tax-Deferred)

- In 2025, the standard 401(k) contribution limit is $23,000.

- If you’re 50 or older, you can make a catch-up contribution of $7,500, bringing the total contribution limit to $30,500.

- Contributions are tax-deductible, reducing your taxable income.

Example Calculation for a 50+ Worker Making $80,000:

- Max 401(k) contribution: $30,500

- Adjusted Taxable Income: $80,000 – $30,500 = $49,500

- If in the 22% tax bracket, the tax savings is:

$30,500 × 22% = $6,710 in tax savings.

Catch-Up Contribution Strategy for Ages 60-63

- The SECURE 2.0 Act increases the catch-up contribution limit for ages 60-63 to $11,250 (starting in 2025).

- This raises the total 401(k) contribution limit to $34,250 for those in this age range.

Example for a 61-Year-Old Worker Earning $80,000:

- Max 401(k) contribution: $34,250

- Adjusted Taxable Income: $80,000 – $34,250 = $45,750

- Tax savings at 22% tax bracket:

$34,250 × 22% = $7,535 in tax savings.

2. Traditional IRA Contributions (Tax-Deferred)

- Contribution limit for 2025: $7,000

- Catch-up contribution (age 50+): Additional $1,000

- Total possible IRA contribution: $8,000

- Contributions reduce taxable income, if eligible.

Example Calculation for a 50+ Individual Earning $80,000:

- Max IRA contribution: $8,000

- Adjusted Taxable Income: $49,500 – $8,000 = $41,500

- Tax savings at 22% tax bracket:

$8,000 × 22% = $1,760 in tax savings.

Note: If covered by a workplace 401(k), the deduction may phase out depending on income level.

3. Health Savings Account (HSA) – Triple Tax Advantage

- If enrolled in a high-deductible health plan (HDHP), HSA contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

- Contribution limit for 2025:

- $4,150 (individual)

- $8,300 (family)

- Catch-up contribution (age 55+): Additional $1,000

- Total contribution for 55+ (individual): $5,150

- Total contribution for 55+ (family): $9,300

Example for a 55-Year-Old Individual with an HSA:

- Max HSA contribution: $5,150

- Tax savings at 22% tax bracket:

$5,150 × 22% = $1,133 in tax savings.

4. Standard Deduction for Seniors (65+)

- The standard deduction for 2025 is expected to be:

- $14,600 (Single)

- $29,200 (Married filing jointly)

- If 65 or older, you get an additional deduction:

- Single: $1,950 extra (Total: $16,550)

- Married (both 65+): $3,900 extra (Total: $33,100)

Example for a Single 66-Year-Old:

- Standard deduction: $16,550

- If taxable income after 401(k), IRA, and HSA contributions is $41,500,

- New taxable income = $41,500 – $16,550 = $24,950

- At 12% tax bracket, final tax:

$24,950 × 12% = $2,994 in taxes.

5. Tax Credits for Older Adults

Retirement Saver’s Credit (For Low- to Moderate-Income Filers)

- If adjusted gross income (AGI) is under a threshold, you may qualify for a tax credit up to $1,000 ($2,000 if married filing jointly).

- Credit phases out at $76,500 for joint filers and $57,375 for single filers in 2025.

Example for a 62-Year-Old Filing Jointly with $50,000 AGI:

- Eligible credit: $400 – $1,000 (depends on contribution amount).

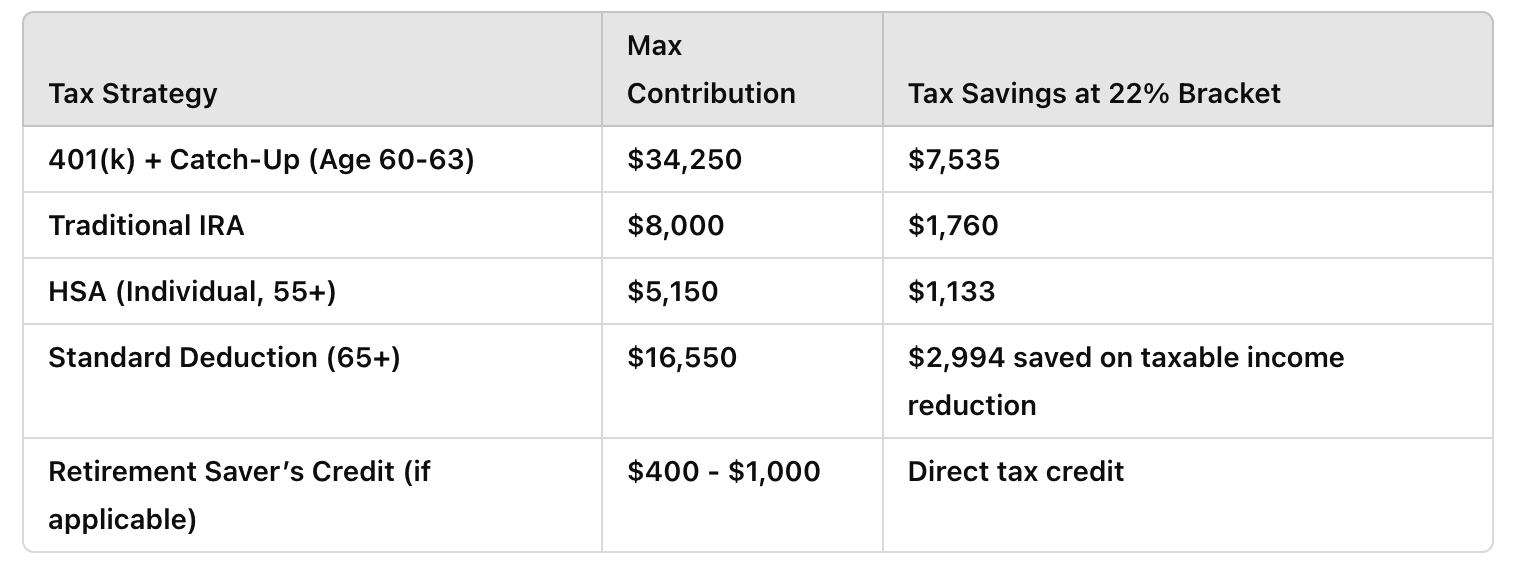

Final Tax Savings Summary for a 61-Year-Old Worker Making $80,000:

Key Takeaways for Adults 50+

-Lê Nguyên Vũ-

To further explore tax breaks and strategies for individuals aged 50 and above in 2025, consider the following resources:

- IRS Announces 2025 Retirement Plan Dollar Limits and Thresholds: This article provides detailed information on the updated contribution limits for various retirement plans, including 401(k)s and IRAs, as well as catch-up contribution provisions for older workers.

- Older Workers Can Now Supersize Their 401(k) Savings: This article discusses the increased contribution limits for workers aged 60 to 63, allowing for higher “super catch-up” contributions to 401(k) plans starting in 2025.

- The IRS Revealed 2025 Changes To Retirement 401(k) and IRA Contribution Limits: This article outlines the IRS’s adjustments to retirement plan contribution limits for 2025, including details on catch-up contributions and income phase-out ranges for traditional and Roth IRAs.

- IRS Releases Tax Inflation Adjustments for Tax Year 2025: This IRS announcement details various tax inflation adjustments for 2025, including changes to standard deductions, tax brackets, and other tax-related thresholds.

- Catching Up on 401(k) Catch-Up Changes for 2025: This article provides insights into the changes in 401(k) catch-up contributions effective in 2025, particularly for individuals aged 60 to 63, and discusses the implications for retirement planning.

These resources offer comprehensive information to help you understand and maximize the tax benefits available to you in 2025.